If you’ve ever wondered how to file your taxes and what to do with your W-2 form, you’re in the right place. In this post, we’ll walk you through the process and provide valuable resources to help you understand this important tax document.

Understanding Your W-2 Form

How to Use the W-2 Form

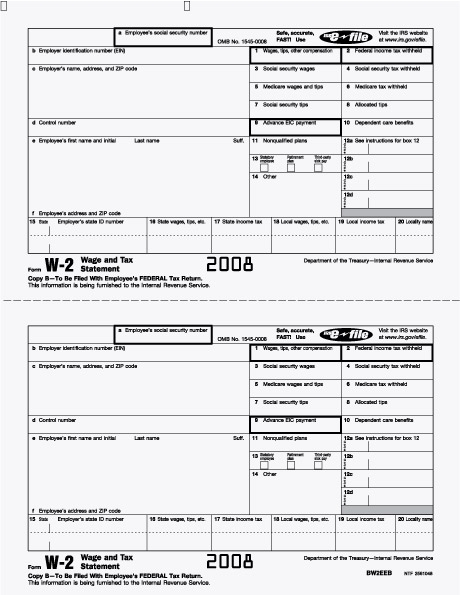

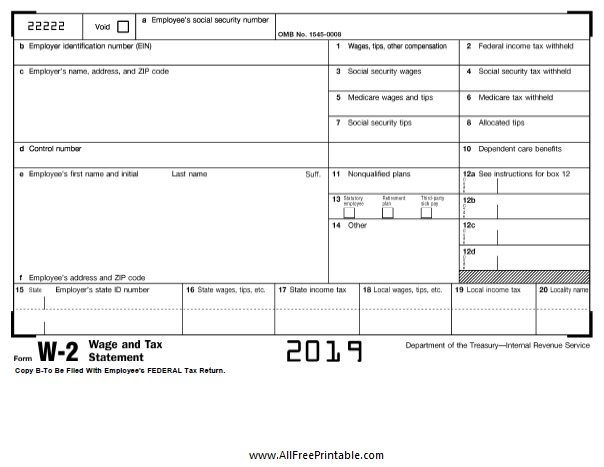

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png) When you receive your W-2 form from your employer, make sure to review it for any errors or discrepancies. Verify that your name, social security number, and other personal information are correct. Double-check the numbers in each box to ensure they match your records.

When you receive your W-2 form from your employer, make sure to review it for any errors or discrepancies. Verify that your name, social security number, and other personal information are correct. Double-check the numbers in each box to ensure they match your records.

The different boxes on your W-2 form provide valuable information:

- Box 1: This box shows your total wages, tips, and other compensation earned during the year.

- Box 2: Here, you’ll find the federal income tax amount withheld from your paycheck throughout the year.

- Box 3: This box reports your total wages subject to Social Security tax.

- Box 4: It shows the amount of Social Security tax withheld.

- Box 5: Here, you’ll find the total wages subject to Medicare tax.

- Box 6: It reports the amount of Medicare tax withheld.

Helpful Resources for Filing Your Taxes

If you prefer to file your taxes manually, rather than using tax software or hiring a professional, printable W-2 forms can be incredibly helpful. You can find a variety of printable W-2 forms online that can be easily filled out and submitted.

If you prefer to file your taxes manually, rather than using tax software or hiring a professional, printable W-2 forms can be incredibly helpful. You can find a variety of printable W-2 forms online that can be easily filled out and submitted.

Other online resources include:

- EZAccounting Payroll: How to Print Form W2

- What Is Form W-2? An Employer’s Guide to the W-2 Tax Form

- W-2 IRS Approved | W-2 Laser Tax Form Copy C | W-2 Forms | Formstax

- Fillable W2 Form 2021 - Fill Online, Printable, Fillable, Blank | pdfFiller

Conclusion

Having a clear understanding of your W-2 form is crucial when it comes to filing your taxes accurately. Take the time to review your W-2 carefully and ensure that all the information is correct. If you have any questions or notice any discrepancies, reach out to your employer for clarification.

Having a clear understanding of your W-2 form is crucial when it comes to filing your taxes accurately. Take the time to review your W-2 carefully and ensure that all the information is correct. If you have any questions or notice any discrepancies, reach out to your employer for clarification.

Remember, these resources are here to help you navigate the tax filing process more easily. Whether you choose to file manually or use tax software, make sure to gather all the necessary documents, including your W-2 form, to ensure a smooth and accurate tax return.

And always remember, when it comes to taxes, it’s better to be proactive and thorough rather than rushing and running the risk of making mistakes. Happy tax season!