Donating to a good cause is a noble act that can have a positive impact on society. One organization that has been making a difference is Goodwill. If you are considering making a donation to Goodwill, it is important to be aware of the process and the benefits that come with it. In this article, we will discuss the donation receipt templates provided by Goodwill and how you can easily fill them out.

Donation Receipt Templates

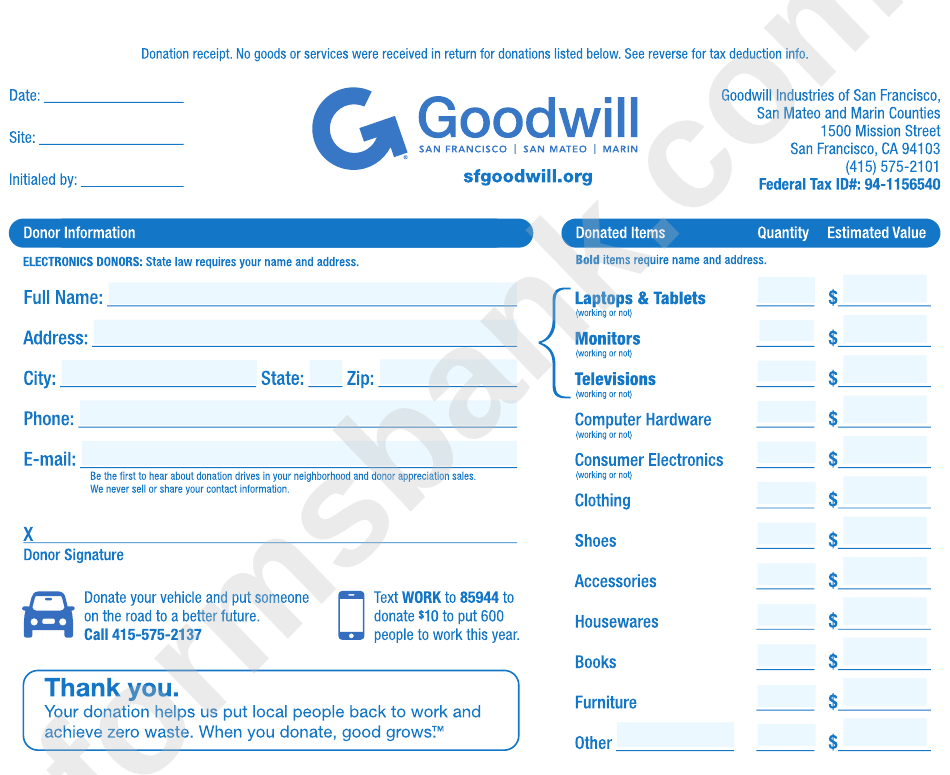

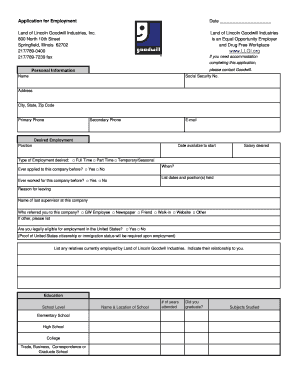

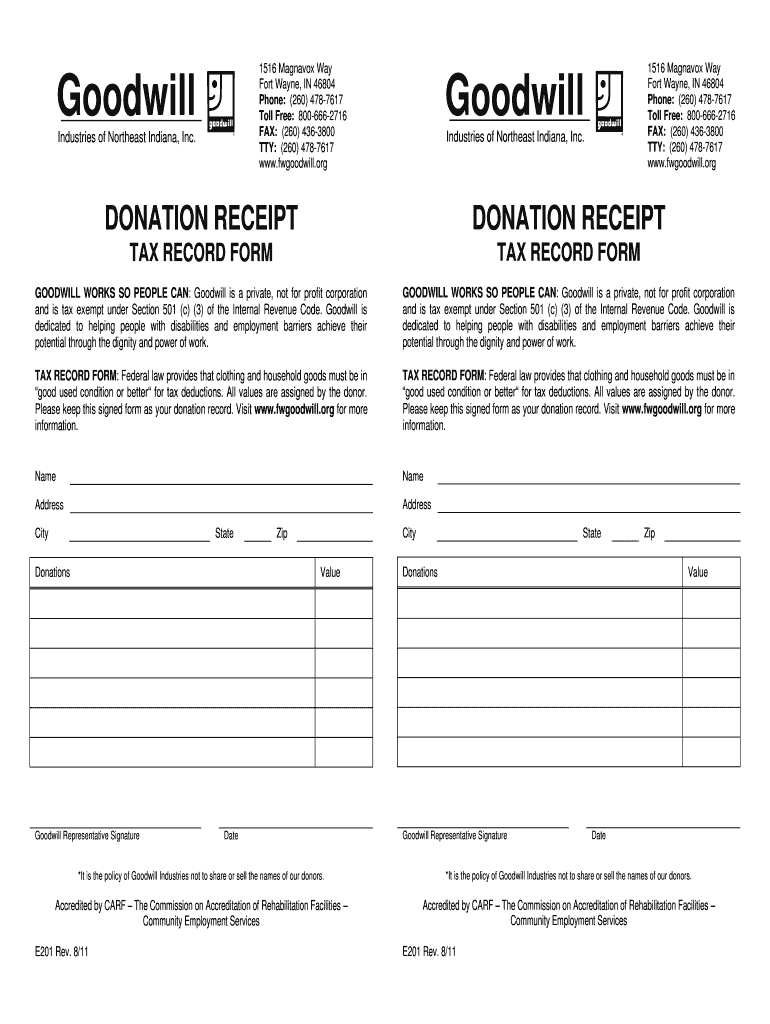

Goodwill offers a variety of donation receipt templates to choose from. These templates are designed to help you easily create a receipt for your donation. Whether you are donating clothing, furniture, or other items, you can find a template that suits your needs. The templates are available in MS Word and PDF formats, making them easily accessible and customizable.

Goodwill offers a variety of donation receipt templates to choose from. These templates are designed to help you easily create a receipt for your donation. Whether you are donating clothing, furniture, or other items, you can find a template that suits your needs. The templates are available in MS Word and PDF formats, making them easily accessible and customizable.

One of the benefits of using these templates is that they are free. You can download them from the Goodwill website or other reputable sources. The templates are user-friendly and provide step-by-step instructions on how to fill them out.

One of the benefits of using these templates is that they are free. You can download them from the Goodwill website or other reputable sources. The templates are user-friendly and provide step-by-step instructions on how to fill them out.

Filling out the Donation Receipt

Once you have chosen the template that fits your donation, it is time to fill it out. The first step is to provide your personal information, including your name, address, and contact details. This information is necessary for Goodwill to send you a tax-deductible receipt.

Once you have chosen the template that fits your donation, it is time to fill it out. The first step is to provide your personal information, including your name, address, and contact details. This information is necessary for Goodwill to send you a tax-deductible receipt.

Next, you will need to provide details about your donation. This includes a description of the items donated, their approximate value, and the date of the donation. Goodwill requires this information to accurately record and acknowledge your contribution.

Next, you will need to provide details about your donation. This includes a description of the items donated, their approximate value, and the date of the donation. Goodwill requires this information to accurately record and acknowledge your contribution.

Tax Benefits

One of the advantages of donating to Goodwill is the potential tax benefits. By properly filling out the donation receipt, you can claim a deduction on your taxes. It is important to consult with a tax professional or refer to IRS guidelines to determine the exact amount you can deduct.

One of the advantages of donating to Goodwill is the potential tax benefits. By properly filling out the donation receipt, you can claim a deduction on your taxes. It is important to consult with a tax professional or refer to IRS guidelines to determine the exact amount you can deduct.

Goodwill’s donation receipt templates are designed to ensure that you meet the requirements set by the IRS. They provide a clear and organized way to document your donation, making it easier for you to claim any potential tax benefits.

Goodwill’s donation receipt templates are designed to ensure that you meet the requirements set by the IRS. They provide a clear and organized way to document your donation, making it easier for you to claim any potential tax benefits.

Conclusion

Donating to Goodwill is not only a way to support a worthy cause but also an opportunity to receive tax benefits. The donation receipt templates provided by Goodwill make the process of documenting your donation simple and straightforward. By filling out these templates accurately, you can ensure that your contribution is properly acknowledged and that you can take advantage of any tax deductions available to you.

Donating to Goodwill is not only a way to support a worthy cause but also an opportunity to receive tax benefits. The donation receipt templates provided by Goodwill make the process of documenting your donation simple and straightforward. By filling out these templates accurately, you can ensure that your contribution is properly acknowledged and that you can take advantage of any tax deductions available to you.

Remember to keep a copy of your donation receipt for your records. This will serve as proof of your donation and can be helpful if you are ever audited by the IRS. Giving back to the community is a wonderful gesture, and with the help of Goodwill’s donation receipt templates, you can make a difference while also benefiting from potential tax deductions.

Remember to keep a copy of your donation receipt for your records. This will serve as proof of your donation and can be helpful if you are ever audited by the IRS. Giving back to the community is a wonderful gesture, and with the help of Goodwill’s donation receipt templates, you can make a difference while also benefiting from potential tax deductions.

So, the next time you decide to make a donation to Goodwill, don’t forget to use their donation receipt templates. They are convenient, easy to fill out, and can help you make the most of your charitable contribution. By supporting Goodwill and following proper procedures, you can make a positive impact and enjoy the potential tax advantages that come with it.

So, the next time you decide to make a donation to Goodwill, don’t forget to use their donation receipt templates. They are convenient, easy to fill out, and can help you make the most of your charitable contribution. By supporting Goodwill and following proper procedures, you can make a positive impact and enjoy the potential tax advantages that come with it.

Let’s continue to support organizations like Goodwill and contribute towards building a better society for everyone.

Let’s continue to support organizations like Goodwill and contribute towards building a better society for everyone.